On its website, SBI says, “SBI Shaurya Home Loan scheme is dedicated to the Army and Defence Personnel of the nation. This special home loan scheme will be only provided to the defence employees.”

If you are a government employees, especially an army and defense personnel, and have been looking to buy a house, then you might want to take a look at largest lender State Bank of India (SBI) services. There are host of schemes on home loan provided by SBI. The lender has brought a scheme called as SBI Shaurya Home Loan which is a one-stop solution for army and defence employees. It offers everything that you desire while opting for home loan. For instance, low interest rate, zero processing fee, no pre-payment charges, maximum tenure and many more services. Simply put, your EMIs are cheaper if you opt for this SBI home loan.

On its website, SBI says, “SBI Shaurya Home Loan scheme is dedicated to the Army and Defence Personnel of the nation. This special home loan scheme will be only provided to the defence employees.”

The SBI Shaurya Home loans will have lower interest rates and other added benefits which will only be provided to the defence employee applicants. Apart from reduced interest rates in the home loan, the defence employees will also have the ease of repayment options and may get longer repayment period of the loaned amount.

Features of SBI Shaurya Home Loan are:

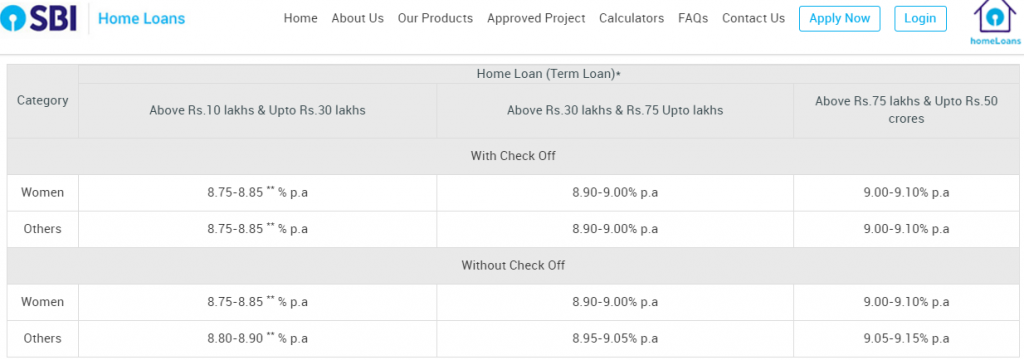

There are two different interest rates provided by SBI: check off and without check off.

Home loan with check off means that the employer agrees to deduct EMIs from employee’s salary and remit the same amount directly to latter’s lender (bank). Generally, loan against salary with check-off faciltiy brings in more flexibility and are seen as more secure, because there is lower chances of lapse in your loan when you trapped in burden with it alone. The employers in this case becomes the guarantor to deduct a portion of your salary every month.

Without check off facilty in home loan is normal one where you can go to your bank and opt for home loan on your cost.

Women interest rates are similar in both SBI’s check off and without check off faciltiy, whereas there is 5 basis point higher rate provided by the lender on home loans for without check off facility to others category. Hence, check off facility is much better to opt.

Additionally, there is a interest concessions for women borrowers and check off home loan.

Also, there is Zero processing fee and no hidden pre-payment charges penalty is levied in this home loan.

Further, one of the interesting key feature is also interest rates on daily reducing balance. What this means is that, your interest rate gets lower each coming day as your principal reduces every day. However, not every one will be able to prepay their loan on daily basis, then this becomes a very less opted facility. But it needs to be noted that, in daily reducing balance, you will get the benefit of the prepayment of your loan immediately. Not like the monthly ones, where you have to wait an entire month to pay your EMIs.

Apart from this, the tenure offered under SBI’s Shaurya home loan is also higher, maximum up to 30 years.

Interest rates are levied depending upon your tenure and principal amount. Also, it is different for women and others categories.

For instance, SBI offers between 8.75% – 8.85% interest rate to women on home loan above Rs 10 lakh but up till Rs 30 lakhs. Then, there is 8.90% – 9% interest rate chargeable on loan between Rs 30 lakhs to Rs 75 lakhs, whereas a rate of 9% to 9.10% is levied on loan above Rs 75 lakh but up to Rs 50 crores. These rates are applicable in both check off and without check off option for women.

In case of other category, the interest rate is similar like women under check-off category. However, there is 5 basis point rise in interest rate on home loans for without check off facility.

This simply means, for other categories government employees that they can enjoy interest rates similar like women within check off facility.

Documents to apply for this loan are – employer identity card, PAN card, passport, driver’s licencse or voter id card and address proof.