Form 61A or Statement of Financial Transactions (STF) is a record of the statement of specified financial transactions which must be furnished under the Income Tax Act, 1961. In this article, we look at Form 61A in detail.

Know more about Statement of Financial Transactions.

Section 285BA

Section 285BA of the Income-tax Act requires the following persons to furnish a statement of specified financial transaction or any reportable account which is being registered, recorded or maintained by them:

- An assessee.

- The specified person who belongs to an office of Government.

- A local authority or other public body or association.

- The Registrar or Sub-Registrar appointed under section 6 of the Registration Act, 1908.

- The registering authority, who is authorized to register motor vehicles under Chapter IV of the Motor Vehicles Act, 1988.

- The Post Master General as referred to in clause (j) of section 2 of the Indian Post Office Act, 1898.

- The Collector referred to in clause (g) of section 3 of the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013.

- The recognized stock exchange referred to in clause (f) of section 2 of the Securities Contracts (Regulation) Act, 1956.

- An officer of the Reserve Bank of India constituted under section 3 of the Reserve Bank of India Act.

- A depository referred to in clause (e) of sub-section (1) of section 2 of the Depositories Act, 1996.

- A Prescribed reporting financial institution.

Specified Financial Transaction

Specified financial transactions are transactions of the following kinds:

- Purchase, sale or exchange of goods, property, right or interest in a property.

- Delivering of services.

- Works contract.

- Investment made or expenditure incurred.

- Taking or accepting any loan or deposit.

It is of great importance to note that the Board may prescribe different values for different transactions in respect of different persons by considering the nature of such transactions. The value or the aggregate value of the transactions in the particular financial year shouldn’t be less than a sum of Rs 50,000.

Due Date for Filing Form 61A or STF

The statement of financial transactions for the previous financial year must be furnished within the 31st of May every year. If the concerned assessee fails to do so, the authorities concerned will issue a notice to the taxpayer, demanding him/her to submit the same within a period of 30 days from the date of issue of notice. If the assessee continues the default by not responding to the notice, he/she will be levied with a penalty that amounts to Rs 500 for each day of default. The penalty will be computed from the expiry of the period stipulated in the notice.

Filing Defective or Inaccurate Form 61A

If the concerned authority finds that the statement furnished by the respective person is defective, he/she may notify the same to the person and demand the necessary rectifications to be made within a period of thirty days of the date of issue of notice, failing which the statement would be declared void.

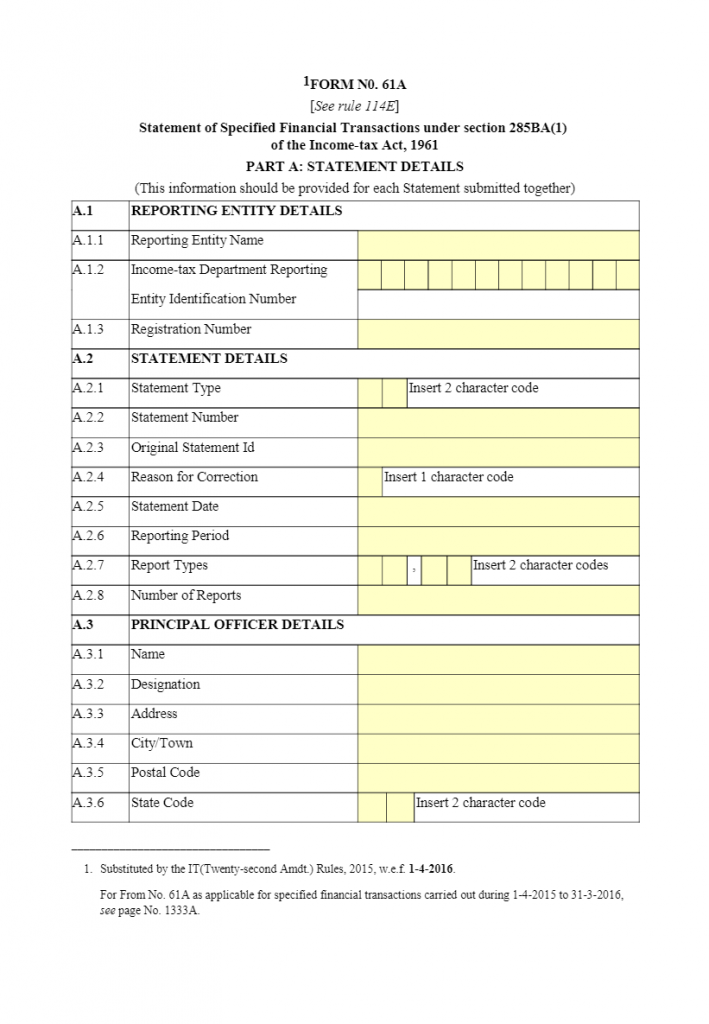

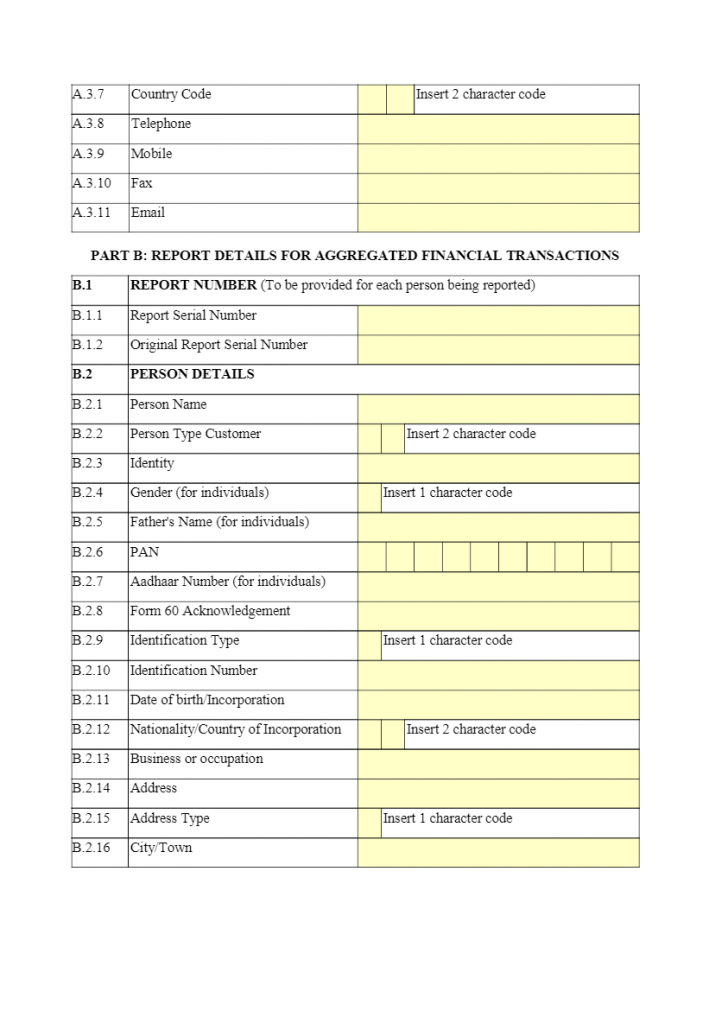

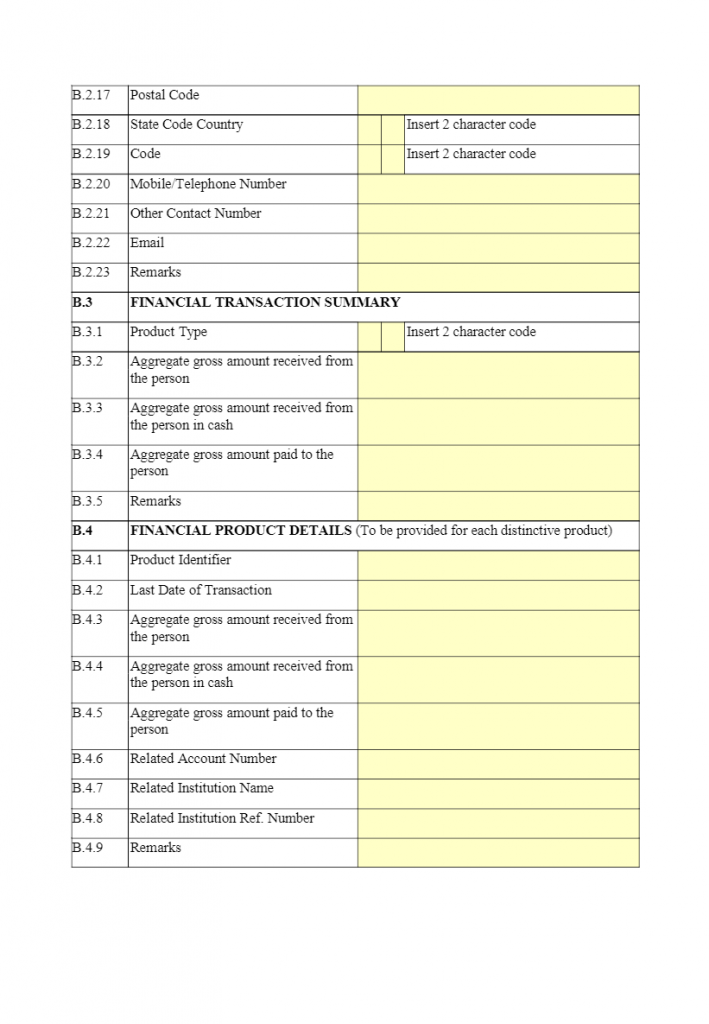

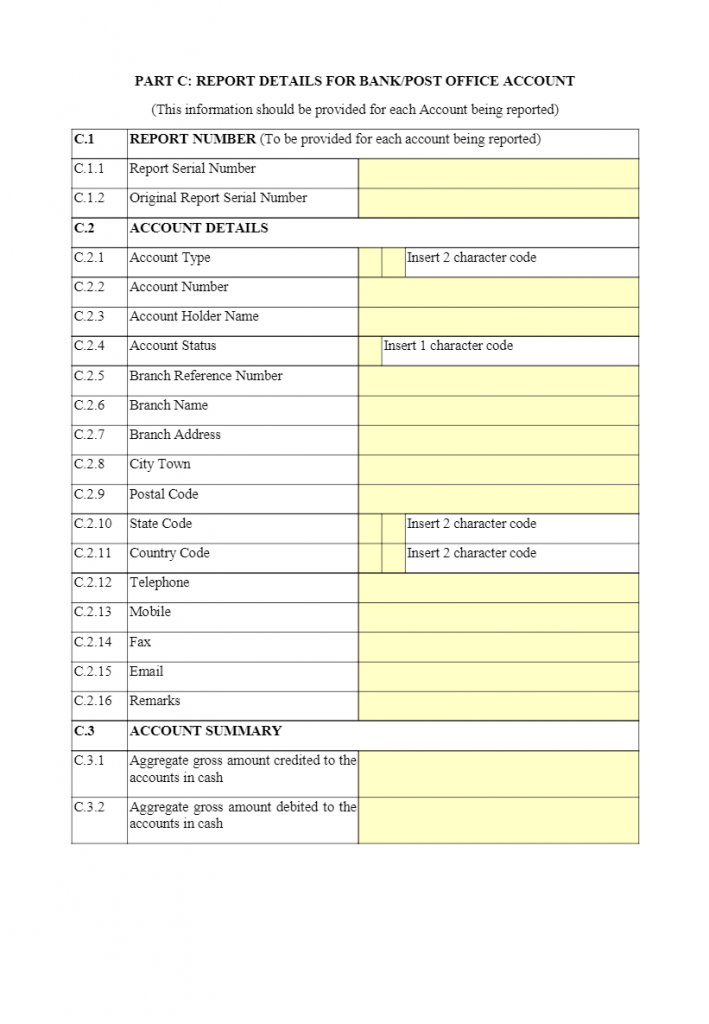

Form 61A

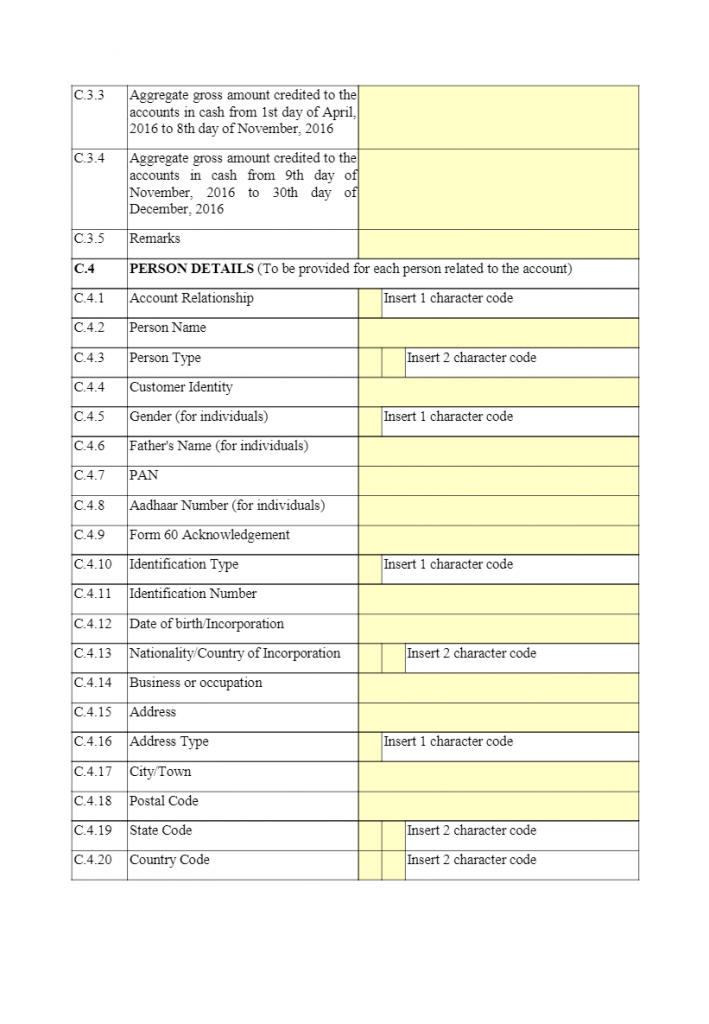

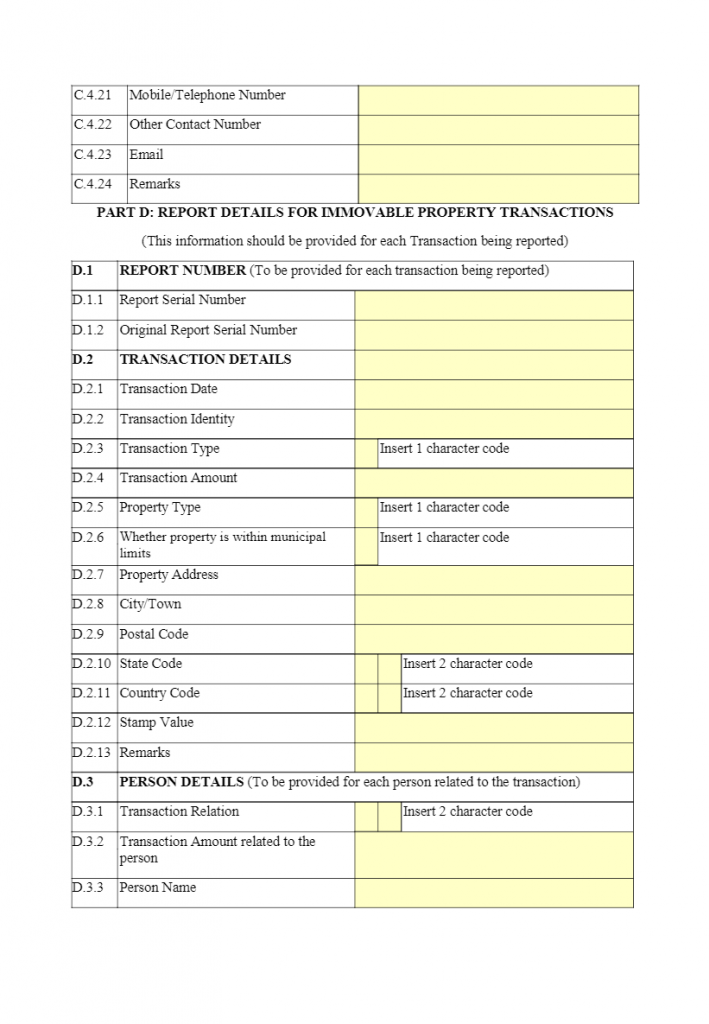

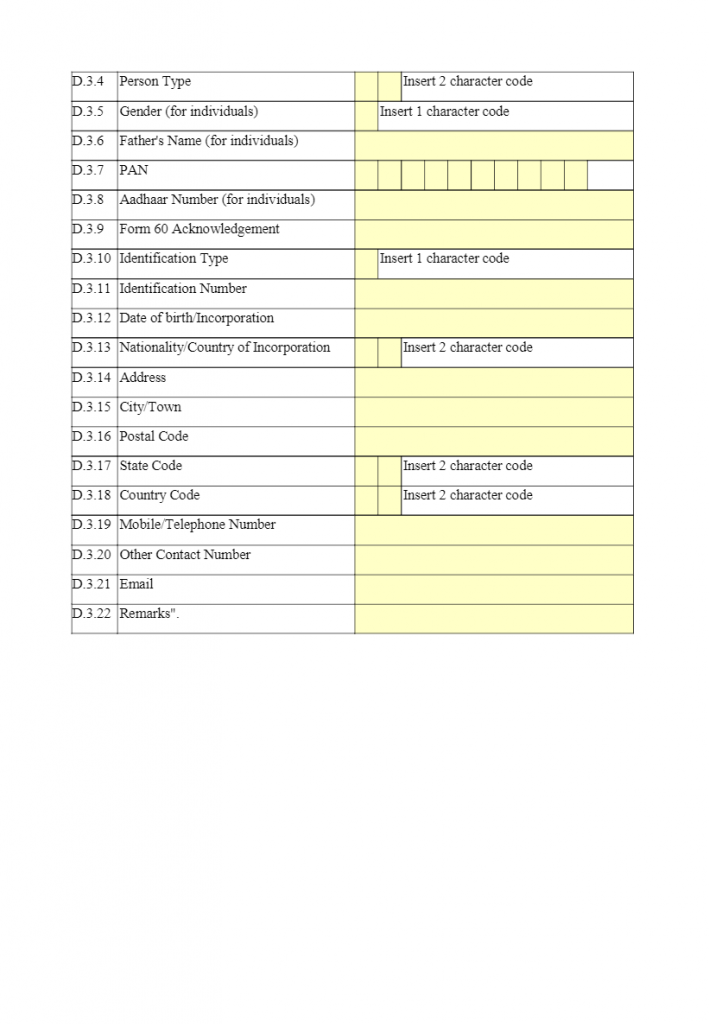

Form 61A is reproduced below for reference: