The zero-balance savings account from India Post Payments Bank offers you an interest rate of 4% and comes without any capping on number of transactions. Here are some other benefits of having an IPPB account.

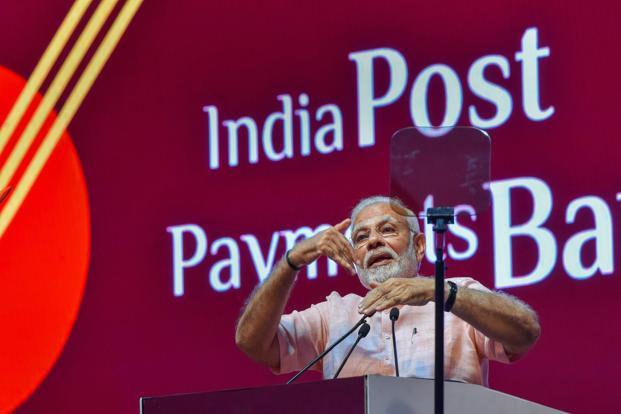

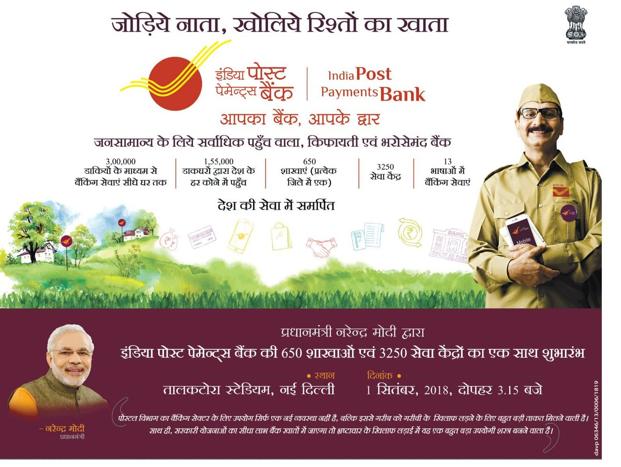

New Delhi: Launched last week by Prime Minister Narendra Modi, India Post Payments Bank (IPPB) offers three types of savings accounts—regular, digital and basic. As the name suggests, a digital savings account can be opened through the IPPB mobile app while the remaining two have to be done either through the post office or the postman. Besides the ease of making payments, the best part of these three savings accounts is that they come without any liability of maintaining a minimum balance. IPPB savings accounts are therefore zero-balance accounts.

Minimum/maximum balance rules:

Since these are zero-balance accounts there are no minimum balance rules. However, you need to take care of the maximum balance. The Reserve Bank of India (RBI) has restricted all payments bank account holders to hold more than Rs 1 lakh in any account at a given point of time. So the moment your IPPB account crosses the Rs 1 lakh limit the transaction will be rejected automatically.

To escape the hassle, IPPB has a simple solution. Open a post office savings account and link it with your IPPB account. Any balance in excess of Rs 1 lakh will be transferred to your post office account, which is a regular savings bank account.

Interest rate on IPPB account:

All IPPB accounts attract an interest rate of 4% per annum. Calculated on your daily closing balance, the interest rate is paid quarterly.

Deposit/withdrawal rules:

In regular and digital savings accounts, you can also withdraw or deposit as many times as you want. In case of a basic savings account, there is a restriction of 4 cash withdrawals monthly. For cash deposits and withdrawals, you need to go to the nearest post office where the IPPB service is available. You can also call the postman or Grameen Dak Sevaks (GDS) home and make both digital and cash transactions using the QR card you get with your IPPB account. However, doorstep banking isn’t free. You have to pay Rs 25 for every cash-based transaction at your home and Rs 15 for a digital transaction at home.

In case you are using the IPPB app to make payments then there no charges.

Since the IPPB accounts do not come with an ATM card you can’t withdraw cash from ATMs.

Digital savings account rules:

Like other payments bank, IPPB also allows opening of digital savings accounts so that you can open them at home without hassles. However, it is valid only till 12 months. Within a year you have to convert it into a regular savings account by providing your biometric data to the postman. If you fail to do so, the digital savings account will be closed.