Tax experts claimed that while the weekly offs and public holidays are considered as working days for taxpayers and businessmen, the case is not same with government employees. The matter has been brought to notice of the tax authorities in New Delhi as well

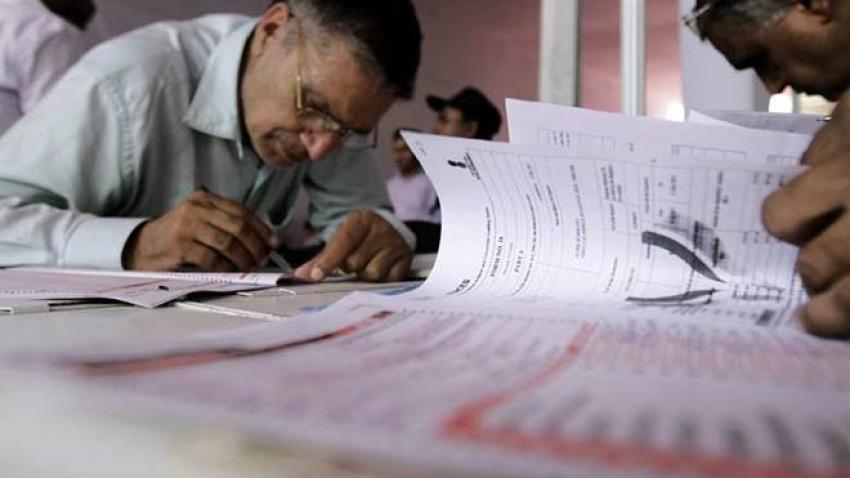

Income tax returns (ITR) filing penalties: There should be uniform definition of working days of government staff, tax payers and businessmen, said tax experts on Friday in a letter they shot off to the state government. They claimed that while the weekly offs and public holidays are considered as working days for taxpayers and businessmen, the case is not same with government employees. The matter has been brought to notice of the tax authorities in New Delhi as well.

The Gujarat Sales Tax Bar Association (GSBTA) recently wrote a letter to the tax authorities in the state as the issue cropped up after the rollout of Goods and Services Tax (GST) last year. The stringent deadlines have resulted in businessmen unable to file returns and pay taxes within set deadline resulting in financial penalties.

“There are two sets of rules with regard to working days. For taxpayers and businessmen, working days also include weekly holidays and public holidays. If in such case the returns are not filed on time or tax not paid, businesses have to pay late fees. These are not binding for the authorities in tax administration,” said Varis Isani, president of GSBTA.

GSBTA said that frequently public holidays, and often popular festive occasions, coincide with deadlines for filing returns or payment of taxes. GSBTA sources said the government authorities have responded favourably to their suggestion. “They have principally agreed and assured us that they will do needful on this issue and will come out with a positive and favourable result,” said sources.