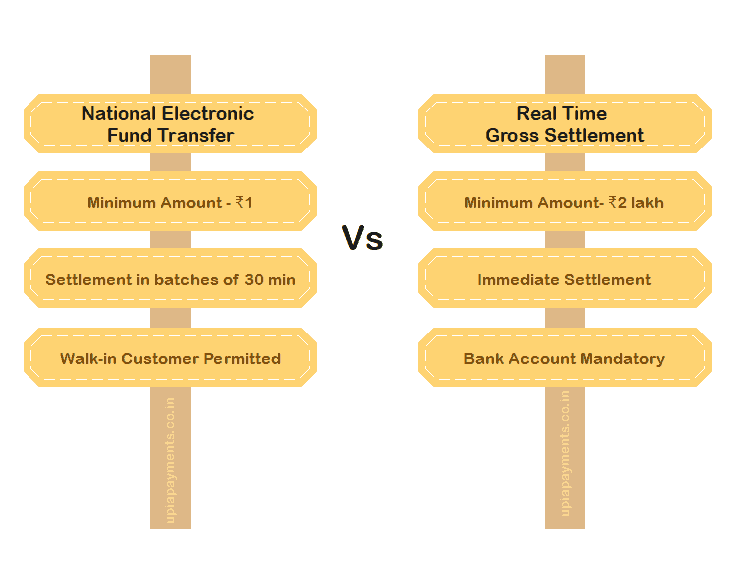

NEFT and RTGS are the two older ways of fund transfer. These are still used Because It gives some exclusive benefits. But in this post, I would discuss the difference between the NEFT and RTGS. You would learn the different usage of these two methods of payment. I hope, after reading this post you would select the best payment method for you.

Difference Between NEFT and RTGS

| NEFT | RTGS | |

| Full Form | National Electronic Fund transfer | Real Time Gross Settlement |

| Minimum Payment | ₹1 | ₹2 lakh |

| Maximum Payment | No Limit | No Limit |

| Maximum Cash Payment | ₹50,000 | Nil |

| Fund Transfer Mode | Payment is done in batches. The minimum difference between two batches is 60 minutes | The Payment is done continuously. The transfer is processed instantly |

| Clubbing of Mandate | Many fund transfer mandates are clubbed together and settled simultaneously in batches | Each mandate is settled individually |

| Walk In Customer | The Customer who has not a bank account with a branch can also use NEFT to send Money | Walk-in Customer can’t use RTGS |

| Working Hours | 8 AM to 7 PM (Week Days) 8 AM to 7 PM (First and Third Saturday) |

9 AM to 4:30 PM (Week Days) 9 AM to 4:30 PM (First and Third Saturday) |

| Maximum Charges /transaction (To Other Bank Account) |

Up to 10,000: ₹2.5 10,000 – 1 lakh: ₹5 1 lakh – 2 lakh: ₹15 Above 2 lakh: ₹25 |

2 lakh – 5 Lakh : ₹30 Above 5 Lakhs: ₹55 |

| Money Credit Expectation | Within 2 hours of the Batch settlement | Within 30 minutes of Initiating Transfer |

| Refund of Failed Transaction | Within 2 hours of batch settlement | Within 1 hours of payment to the beneficiary bank |