While you can continue recharging for pre-paid mobiles or pay postpaid bills, money transfer to bank accounts is no longer permitted.

With the deadline for complying with full KYC norms for e-wallets ending on February 28, Paytm has put out a blog where they claim that users can still make payments and use their e-wallet.

As per the blog, to add money to your Paytm account, the limit has been reduced to Rs 10,000 for those who haven’t done KYC. Customers can use their credit/debit cards, net banking and UPI on the e-commerce platform of Paytm to make payments and continue to do transactions.

Paytm has clarified that without KYC, transferring amounts out of their Paytm wallets back to their bank accounts or to make cash transfers to other Paytm accounts is not permitted. However, making payments with the Paytm wallet for services like Uber, Zomato, Swiggy, Big Basket, can be continued without any hindrance.

There is also no change in recharging of pre-paid mobile phones or paying of post-paid bills.

If you are a Paytm wallet user and used your Paytm Balance to send money to your friends, then it will be restricted without KYC. RBI guidelines restrict P2P payments from the e-wallet.

However, to find a way around this, Paytm has launched Bank to Bank Money Transfer at 0% charge, which lets users keep sending money to their friends without needing KYC. All one needs to do is to link their bank account with Paytm using UPI and continue to send money to any bank account free of cost.

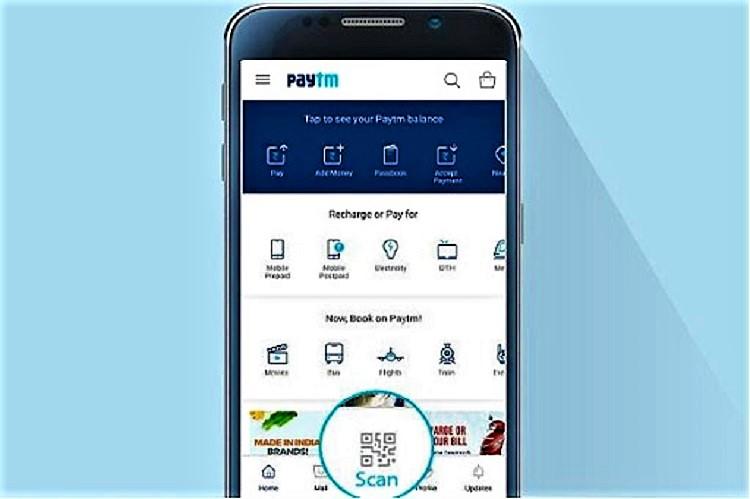

Using the Paytm e-wallet in shops and other merchant establishments can also be continued as before using the QR code scanner; the only exceptions are where the merchant establishments have themselves not complied with the KYC norms.

“In some cases you may face some issues if the shop you are trying to pay is not a certified Paytm merchant but is accepting Paytm in their personal account. In such cases, we suggest that you use our new “Refer a Merchant” and we will quickly convert that shop as our merchant so that next time you can pay easily using Paytm,” the blog post clarifies.

Lastly, Paytm has also come up with a solution to make the transfer of cash from Paytm e-wallets even without the Aadhaar KYC verification. For this, the users will have to subscribe to UPI, by downloading the BHIM app and linking their bank accounts with Paytm via UPI and they are good to go.

Having explained all this, Paytm has advised its subscribers to comply with the KYC norms as per the RBI guidelines and link their Aadhaar number with the e-wallet.