Over ₹ 15,000 crore of unclaimed insurance money is lying with 23 life insurers, according to latest data from insurance regulator Irdai. India’s biggest life insurer LIC or Life Insurance Corporation of India is sitting on over two-thirds of that unclaimed money while the other 22 private life insurers account for the rest, according to a PTI report. LIC has ₹ 10,509 crore of unclaimed insurance money while among private insurers, ICICI Prudential Life Insurance Co. Ltd has ₹ 807 crore, followed by Reliance Nippon Life Insurance (₹ 696 crore), SBI Life Insurance Co (₹ 678 crore) and HDFC Standard Life Insurance (₹ 659 crore), says the report.

Insurers are required to update information regarding unclaimed amounts on their websites on half-yearly basis. The regulator has asked insurers to provide a facility on their website to enable policyholders or beneficiaries or dependents to find out whether any unclaimed amounts due to them are lying with these companies.

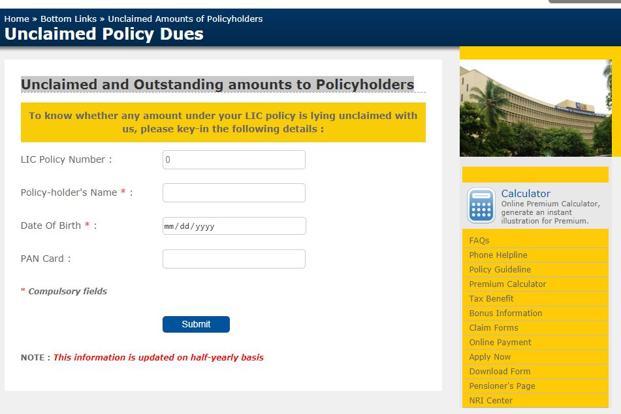

LIC has provided a facility on its website for checking unclaimed insurance money. To know whether any amount under your LIC policy is lying unclaimed with the insurer, here are some details which the insurer needs: LIC policy number, policy-holder’s name, date of birth, and PAN card.

If insurers’ websites shows any unclaimed insurance money, the insurance policyholder or the beneficiary, can approach the insurer directly. Insurers process the payment only after completing the KYC (know your customer) formalities. Insurers may have more layers of verification to prevent fraud.

According to current rules, all insurers, including LIC, having unclaimed amount of policyholders for a period of over 10 years have to transfer the money to Senior Citizens Welfare Fund (SCWF), created by the government. This fund is used for promoting the welfare of the senior citizens. If no claim is made for 25 years after the transfer to Senior Citizens Welfare Fund, the money will be transferred to the central government. The insurance policyholder or the beneficiary won’t be able to claim it.