If you have more than one PAN, whether acquired intentionally or inadvertently, you run the risk of being penalised. Following government’s mandate to link PAN with Aadhaar, and Aadhaar with bank accounts, detecting multiple PANs could become easier for the Income Tax Department once the data is collated.

As per Section 139A of Income Tax Act, 1961 a person can hold only one PAN. This section deals with the eligibility to apply for PAN, when an individual is supposed to quote it and so on. The seventh provision of this section states, “No person who has already been allotted a permanent account number under the new series shall apply, obtain or possess another permanent account number.”

As per the Section 272B of the Income Tax Act, the income tax officer can levy a penalty of Rs 10,000 on a person for having more than one PAN.

Explaining Section 272B in detail, Shalini Jain, Tax Partner, EY says “penalty under Section 272B is not specific, but discretionary. It says if a person fails to comply with the provisions of section 139A, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of ten thousand rupees. This means, a person who is eligible to apply for a PAN and doesn’t have it, or a person who is intentionally not quoting it while corresponding with the Income Tax Authority, and a person who has multiple PANs can be slapped with a fine of Rs 10,000. The section further says that the defaulter will be given an opportunity of being heard to explain to the Accessing Officer (AO) that it is an unintentional mistake.”

There can be genuine cases, where individuals have been inadvertently allotted more than one PAN, says Jain. “NRIs come to India for business and apply for a PAN. When they revisit India again after 5 or 10 years, unintentionally, they may end up applying of PAN again,” she explains.

For instance, if an individual loses his PAN card and wants it to be reissued, but the address is different from the one provided at the time when PAN was issued, and there’s a discrepancy in the proof of the first address, he is likely to face problem. In such cases to avoid the hassle involved in applying for reissuance with address change, sometimes a person may apply for a new one and end up having two PANs.

So, if by any chance, you have more than one PAN, you should surrender it and there’s a prescribed procedure to do that. This can be done online as well as offline by filling out PAN correction form.

ONLINE METHOD

Since it is the same form which is to be filled out for correction and surrender, procedure is also somewhat similar. Here’s the step-by-step low down to go about it.

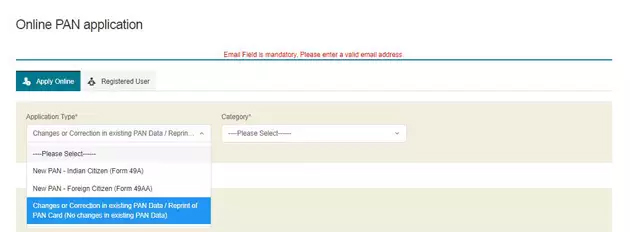

Visit NSDL Online by clicking here: https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

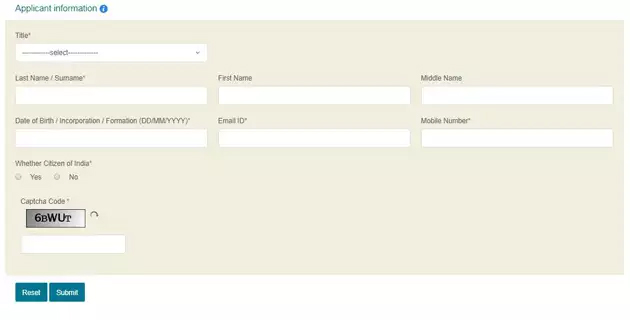

Select PAN correction option from the application type dropdown, and fill out your personal details.

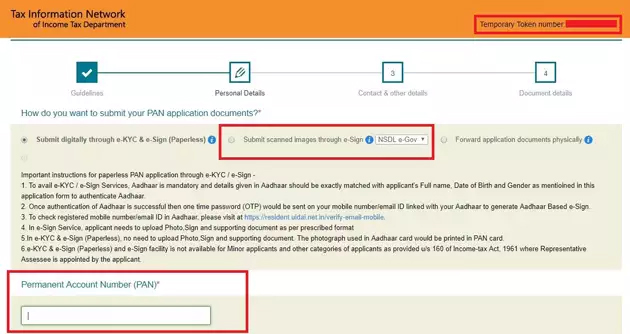

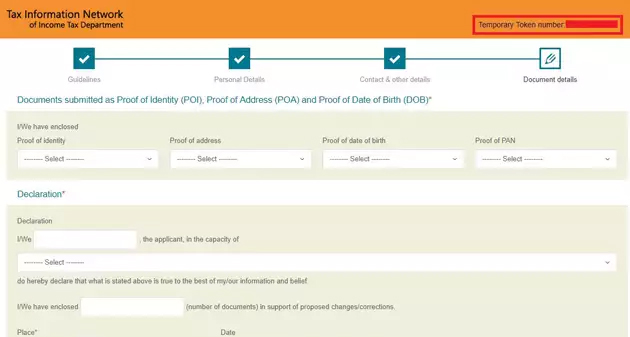

After submitting, you will be redirected to a new page. A token number will be generated and displayed to the applicant before filling the form. This token number would also be sent on email provided in the application for reference purpose. On the top of the page, check mark the option ‘Submit scanned images through e-Sign’ and under that mention the PAN number you want to retain. Fill out your personal details in the remaining part and click next. Fields marked as * are mandatory to fill. Do not select the corresponding check box on left margin of the given field since those are for the purpose of correction.

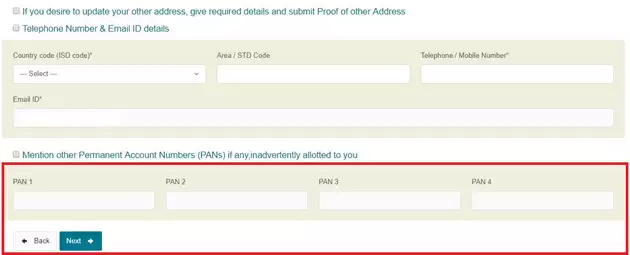

On the next page in the bottom, mention the additional PANs inadvertently allotted to you that you want to surrender and click on ‘Next’.

Important note

For cancellation of PAN, fill all mandatory fields in the form, enter PAN to be cancelled in the form and select the check box on left margin against the corresponding field. PAN to be cancelled should not be same as PAN (the one currently used) mentioned at the top of the form.

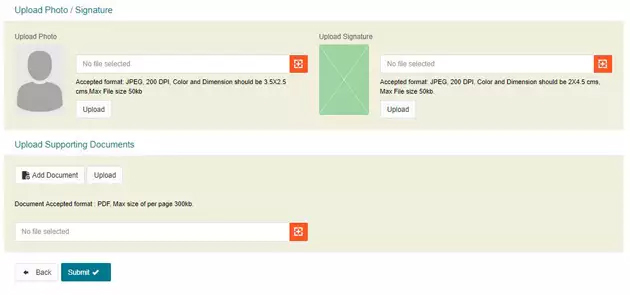

On the next screen select the Proof of identity, residence and date of birth you want to submit. Upload the scanned images of your photograph, signature and the documents you have selected.

After submitting you will get a preview of your application form. Verify your details in the preview form, make the necessary edits if required, and proceed to make the payment.

Payment

If communication address is within India, the processing fee for PAN application is Rs. 110. For communication address outside India the processing fee is Rs 1020. Payment can be made either by demand draft, credit or debit card or internet banking. The demand draft, if used, shall be in favour of ‘NSDL – PAN’ and be payable at Mumbai. Name of the applicant and the acknowledgment number should be mentioned on the reverse of the demand draft.

Acknowledgement

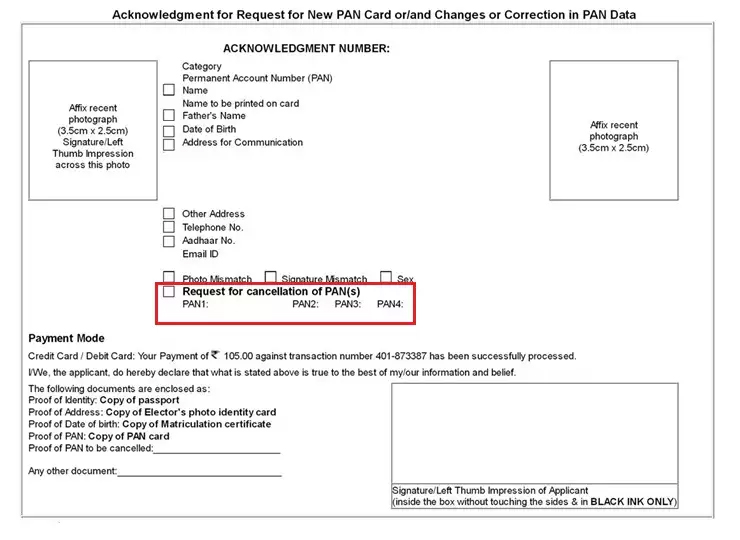

After making the payment, a downloadable acknowledgment will be displayed on the screen. Save the acknowledgement for future reference, print it and send it to NSDL e-Gov. Individual applicants applying for surrender need to fix two photographs in the space provided in the acknowledgement and cross-sign it in such a manner that portion of signature is on photo as well as on acknowledgement receipt.

If the applicant is not an individual, the acknowledgement receipt shall be signed by the authorised signatory (Karta in case of HUF, Director in case of Company, Partner in case of Partnership Firm / LLP, Trustee in case of Trust and Authorized signatory in remaining categories).

Submission

Superscribe the envelop with ‘Application for PAN cancellation’ along with the acknowledgement number.

The acknowledgment duly signed, affixed with photographs along demand draft, if any, proof of existing PAN, proof identity, address, date of birth is to be sent to the following address:

NSDL e-Gov at ‘Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016.

OFFLINE METHOD

To surrender the additional PAN offline you need to submit the PAN correction form at the nearest NSDL collection centre and also file a letter with the jurisdictional Assessing Officer listing the duplicate PAN details and requesting for cancellation of the same.

“Practically, the Assessing Officer may require an affidavit mentioning the current PAN and stating that the individual does not own any other PAN other than the current one in use and the PAN being surrendered,” adds Jain.

Click here to download the form

Column 11 of this form will allow you to mention the PAN which you want to surrender. A copy of such PAN should also be submitted along with the application.

Important Watch outs

1. In case of online application, the duly signed acknowledgement with required documents should reach the NSDL within 15 days of submitting the online form.

2. PAN correction form is used for multiple purposes, i.e. to make correction in PAN, reissuance of PAN without correction and to surrender additional PAN, so it has to be filled out carefully.

3. Checkbox on the top left of the corresponding fields should be marked and checked properly, since selecting the wrong box would create more problems for you. For instance, if you are applying to surrender the PAN and check mark the box against your name or birth date, your application type will be different from what you intend to submit.

4. There’s a possibility that Income Tax officials will probe the details of surrendered PAN, returns filed against it and the income disclosed, so one should be prepared to face questions. Since you will get an opportunity to be heard, if you are not a wilful defaulter, you should be able to justify your case.

5. There is also a possibility that the Income Tax Officer will not cancel your additional PAN immediately. He may take time to probe the request and until he is satisfied, your request won’t be processed.

6. Merely filling out the online form does not ensure that your PAN will be cancelled. You may have to visit your Assessing Officer to convince him that your additional PAN was inadvertently acquired.

Source of information given above is NSDL website as on July 21.