How to respond to income tax notice online

You are likely to get a notice if there is a discrepancy in the income tax calculated and paid by you while filing your income tax return (ITR) and that computed by the income tax department. Once you have verified your ITR after submitting it, the I-T department cross checks the income declared and tax paid by you with the information available with them.

While processing your return, if the tax department assesses that more tax is due from you than paid and declared in your return, then you would normally get a demand notice.

The intimation will be sent to you regarding the same via email and SMS under section 143(1). You will find the tax demand notice on your online account on the e-filing website. According to the current income tax laws, the time limit to respond to this is 30 days. If you do not respond to the notice within the stipulated time period, the department can take action against you.

Chetan Chandak, Head of Tax Research, H&R Block India says, “If as per the intimation u/s 143(1) there is a tax demand then this intimation becomes notice of demand and this intimation will be treated as Notice of demand u/s 156. Accordingly, you will have to pay the entire amount within the time mentioned in the notice.”

If the person to whom the section 156 tax notice for demand has been issued fails to pay the amount demanded within the time limit, then the assessee is liable for the following penalties:

- Interest u/s 220- Interest at the rate of 1 percent each month or part thereof is payable after the expiry of the 30 days time provided under section 156 tax notice.

- Penalty u/s 221- A penalty u/s 221 may be imposed by the assessing officer on the assessee but it should not be more than the amount demanded in the Demand Notice, adds Chandak.

There was a time when you got such an intimation of outstanding tax demand, you would have to go to an income tax office on the date and the time specified in the notice. However, the government has been taking measures to make this procedure taxpayer friendly by providing e-assessment methods.

Chandak says a taxpayer can follow the following steps to respond to a tax demand notice using the e-filing website.

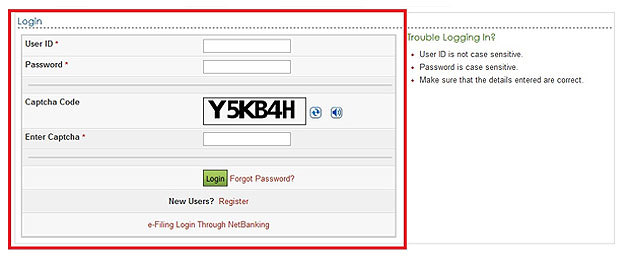

1. Login to your account on the e-filing website by entering your credentials: User ID (PAN), password, and captcha code.

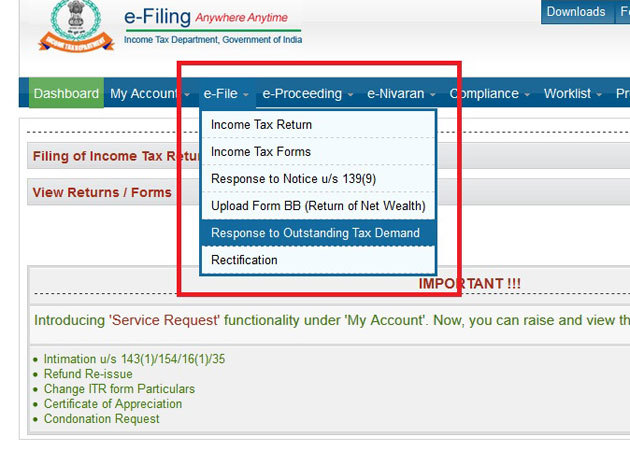

2. Click on the ‘e-file’ tab and select ‘Response to outstanding Tax Demand’ option.

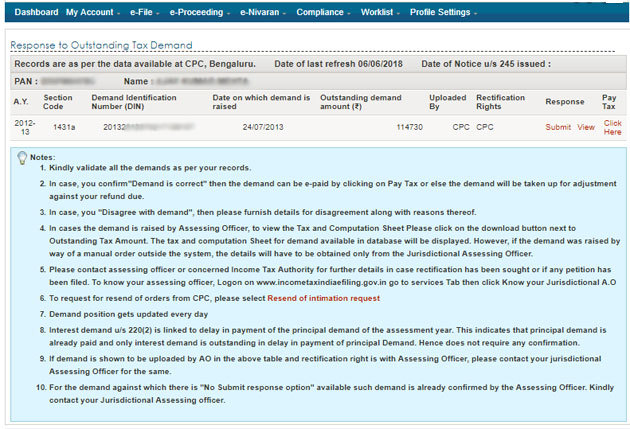

3. An outstanding tax demand notice will appear on your screen with details such as assessment year (AY), section code (under which the notice has been served), demand identification number etc.

4. Click on ‘Submit’ in the response column for the appropriate AY to submit your response. The assessee has to select one of these options:

A) Demand is correct

B) Demand is partially correct

C) Disagree with demand

D) Demand is not correct but agree for adjustment

a) If you select option A

If you select the ‘Demand is correct’ option, you will get a pop up with this message ‘If you confirm demand is correct then you cannot disagree with the demand’.

Click on submit if you agree with the department’s calculations and you will get a success message. If there is any tax amount due, you have to pay it immediately.

Click on the hyperlink given under the column ‘Pay Tax’. Click on ‘Confirm’ and you will be re-directed to the TIN website of NSDL which will help you pay your outstanding tax. Make sure that all the relevant auto-populated information is correct. Select bank name, enter captcha code, and click on proceed.

Click on submit to bank button to make the payment. Once you have made the payments, you will be required to submit your response under the ‘Response’ column.

b) If you select option B

If you select the ‘Demand is partially correct’ option, then two amount fields will appear on your computer screen.

The amount in the incorrect column will be filled automatically as the difference between outstanding demand and correct amount. You have to enter the amount which you believe is correct.

You are also required to select the reason given below on the website to justify why the demand is partially correct.

The reasons mentioned on the portal are as follows:

(a) Demand paid

i) Demand paid and challan has CIN

ii) Demand paid and challan has no CIN

(b) Demand already reduced by rectification/revision

(c)Demand already reduced by the Appellate order but appeal effect to be given

(d) Appeal has been filed

(i) Stay petition filed with

(ii) Stay granted by

(iii) Instalment granted by

(e) Rectification/Revised return filed at CPC

(f) Rectification filed with AO

(g) Others

Based on the reason/s selected, you will be required to provide additional information.

c) If you select option C

If you believe that the tax demand raised by the department is incorrect, you can select the option, ‘Disagree with the demand’. Just like option (B), you will be required to select from the same reasons as mentioned above.

d) If you select option D

If you select ‘Demand is not correct but agree for adjustment’, then you will have to mention the reasons for your disagreement. The reasons are same as those mentioned above.

Enter the necessary details and click on ‘submit’.

Once the information is successfully sent to the department, then a transaction ID will be generated.

You can check your response by clicking ‘View’ in the response column. You can click on the ‘transaction ID’ to check the response sent by you to the department.

Once you have submitted your response, you should check your account every 10-15 days to know the department’s response, adds Chandak.