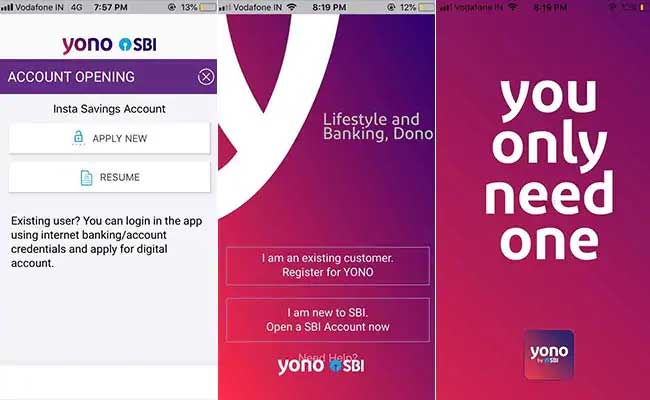

The country’s largest bank enables users to open an SBI account online through a mobile app, called YONO.

SBI’s mobile app YONO enables users to open an Insta Savings account without visiting a bank branch

State Bank of India (SBI) offers several types of bank accounts that don’t require any minimum balance to be maintained by the customer every month. One such SBI account is Insta Savings Account, in which the account holder need not worry about the bank’s minimum balance rules. That means SBI’s rules pertaining to minimum average balance or MAB – wherein a customer is required to maintain a certain average of the balance in the bank account each month – don’t apply to this bank account, at least for now. For a limited period, SBI is offering the Insta Savings Account without the minimum average balance requirement. This was said by the country’s largest bank SBI on microblogging site Twitter. Till August 31, 2018, SBI said, users can open and use an Insta Savings Account without having to maintain a specific monthly average balance.

Here are 10 things to know about this SBI account (SBI Insta Savings Account through YONO):

1. An SBI Insta Savings account can be opened through mobile app YONO. That means a user can open such an account from his or her smartphone, using YONO.

2. The SBI bank account is opened on a paperless basis, however the account holder is required to take up full KYC (Know Your Customer) by visiting a bank branch within one year of opening the account. Branch-based transactions are allowed after completion of full KYC, it noted.

3. Mode of operation: The bank account is opened on a single basis. That means only one customer can hold the bank account.

4. Minimum balance rules: SBI Insta Savings Account is free from the requirement of monthly average balance till August 31, 2018, the bank noted.

5. Who can open SBI account: SBI’s Insta Savings Account can be opened by Indian residents above 18 years of age. “The account is for new customers with no existing relationships with SBI,” according to the bank.

6. How to open the SBI account online: SBI’s Insta Savings Account is opened through YONO through a paperless process, without requiring the customer to visit an SBI bank branch for activation, according to the bank’s website.

7. Documents required: Users looking to open an SBI Insta Savings Account need to have an Aadhaar with a linked mobile number and a PAN card, it noted.

8. ATM/cash withdrawal: This SBI account comes with a RuPay-branded debit card free of cost, according to the bank. Customers can use this debit card to withdraw cash from ATMs of SBI group or other banks.

9. Account balance requirements: In the Insta Savings Account, SBI allows up to Rs. 1,00,000 as aggregate balance at end of day. Total annual credit transactions can be up to Rs.2,00,000, according to SBI.

10. According to SBI, nomination is mandatory for the Insta Savings Account.

How To Open SBI Account Online Through App Yono (with images)

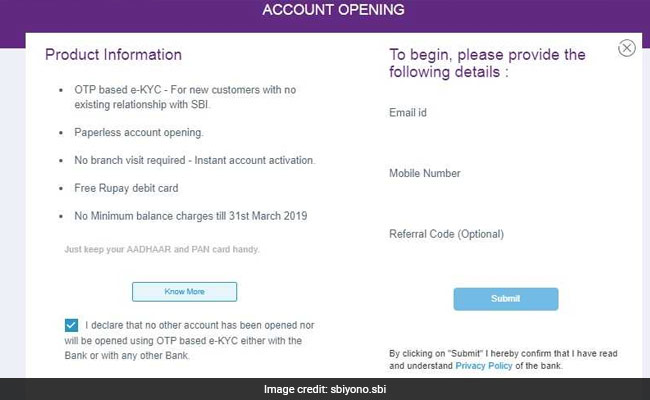

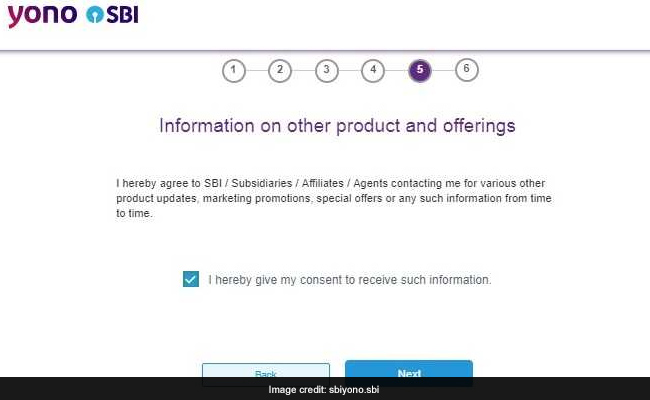

Users can apply for an SBI Insta Savings Account through mobile app Yono or online (through the bank’s website). Both the website and the mobile app assist the user in the account opening procedure through a common process.

Once on the SBI Yono website, the user may proceed by filling in details such as email address and phone number, and clicking the ‘Submit’ button.

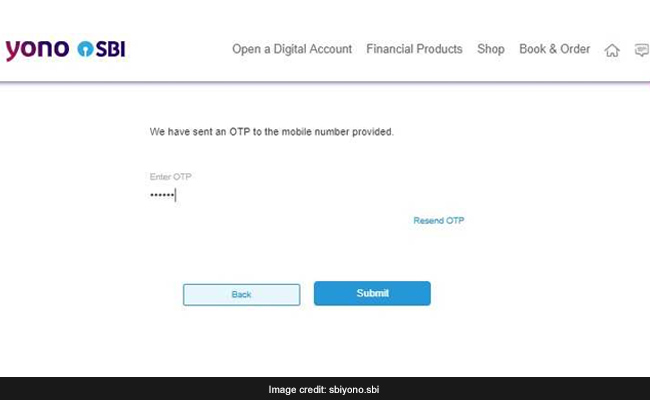

Once on the SBI Yono website, the user may proceed by filling in details such as email address and phone number, and clicking the ‘Submit’ button. On the next page, the website prompts the user to enter an OTP (one-time passcode). This OTP is a numeric code sent to the user’s mobile number. After entering this OTP in the given field, click on ‘Submit’ to proceed.

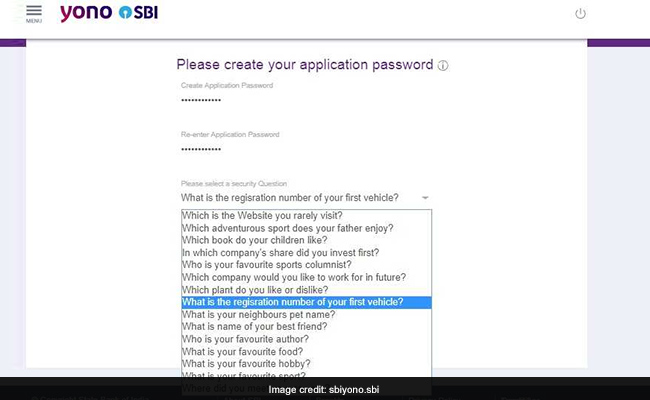

On the next page, the website prompts the user to enter an OTP (one-time passcode). This OTP is a numeric code sent to the user’s mobile number. After entering this OTP in the given field, click on ‘Submit’ to proceed. On the next page, the user is required to set an application password. This password will be used to log in to the YONO app once the account is set.

On the next page, the user is required to set an application password. This password will be used to log in to the YONO app once the account is set.

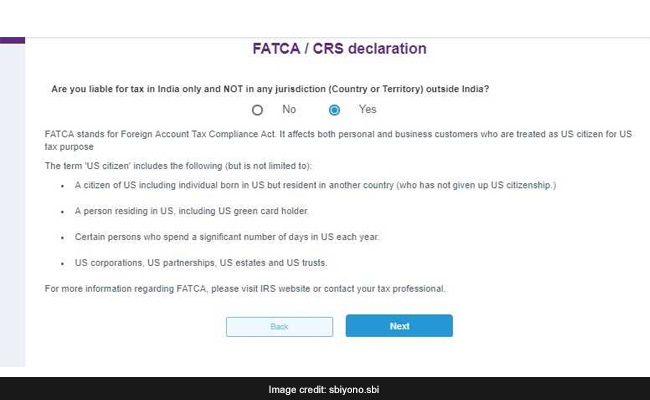

After this, the user is asked to confirm certain tax liability dates under FATCA or Foreign Account Tax Compliance Act. After choosing the correct option, the user may proceed by clicking on ‘Next’.

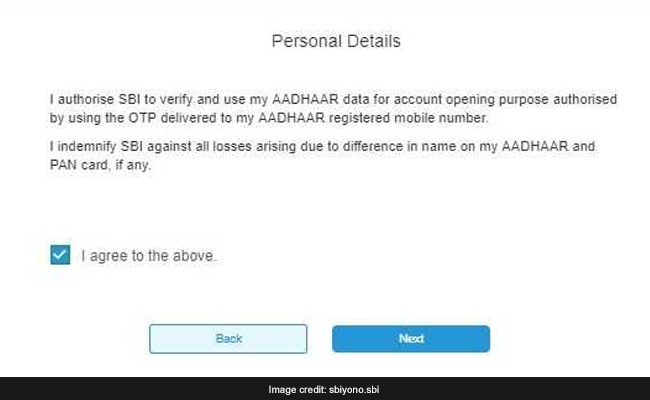

After this, the user is asked to confirm certain tax liability dates under FATCA or Foreign Account Tax Compliance Act. After choosing the correct option, the user may proceed by clicking on ‘Next’. The website then asks the user to authorise SBI to proceed with Aadhaar-based verification for the purpose of opening an account. The user may click on ‘Next’ to proceed.

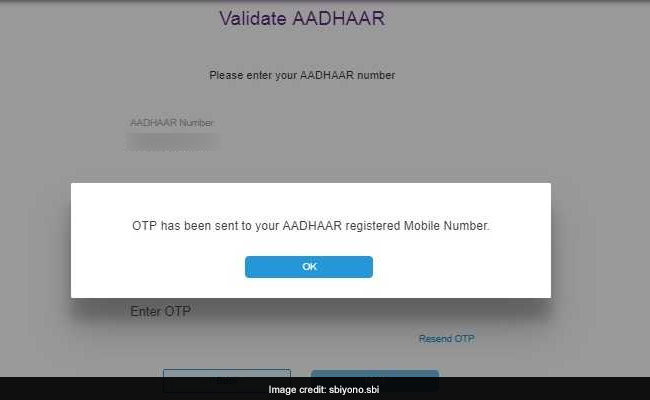

The website then asks the user to authorise SBI to proceed with Aadhaar-based verification for the purpose of opening an account. The user may click on ‘Next’ to proceed. After this, an OTP is sent to the user’s mobile number registered with Aadhaar. In case the details given on Aadhaar are not updated, YONO asks the user to make the required changes through the UIDAI (Unique Identification Authority of India), the issuer of Aadhaar card.

After this, an OTP is sent to the user’s mobile number registered with Aadhaar. In case the details given on Aadhaar are not updated, YONO asks the user to make the required changes through the UIDAI (Unique Identification Authority of India), the issuer of Aadhaar card.

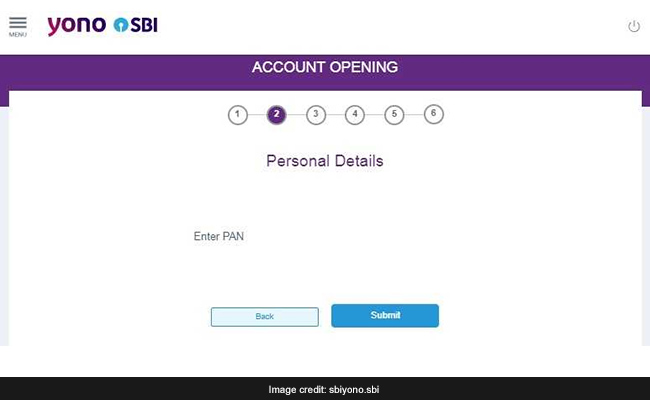

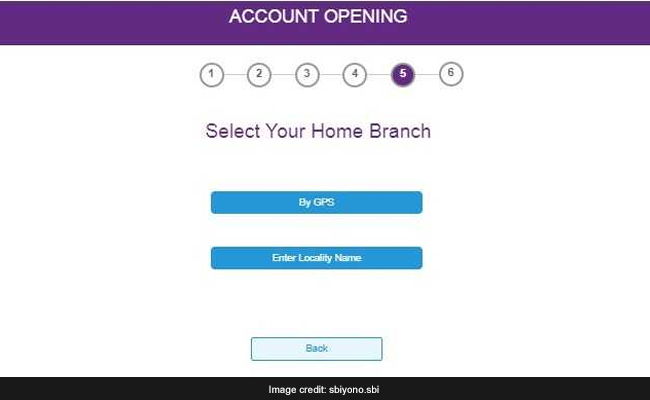

At this stage, the user is required to enter/confirm personal details such as name, address and date of birth. After this, additional details such as PAN and annual income are fed. The user is asked to select a home branch.

The user is asked to select a home branch. This branch will be the SBI branch where the account will be located.

This branch will be the SBI branch where the account will be located. SBI Digital Savings Account

SBI Digital Savings Account

Through mobile app YONO, users can also open a Digital Savings Account. Similar to Insta Savings Account, this account is also opened on a paperless basis. The Digital Savings account requires a single branch visit by the customer, according to the SBI website.