Get up to 71 litres of free fuel every year on credit card spends! Here is how to earn it

Different credit cards offer different ways to redeem credit points depending upon the co-branding. For example, you may book rail tickets by redeeming the points earned on IRCTC co-branded card or book a flight ticket by using reward points accumulated on a credit card that is issued by a bank on co-branding with an airline.

Similarly, there are some cards that are issued after co-branding with fuel retailers and offer fuel against the reward points. Citi Bank has issued such a card after co-branding with Indian Oil. Using this card, according to the bank, a customer may earn up to 71 litres of free fuel in a year.

According to the features of the card, you would get 4 Turbo Points on Rs 150 spent on fuel at authorised Indian Oil outlets and each Turbo Points may be used to get free fuel worth Re 1 (i.e. 1 Turbo Point = Re 1 Free Fuel). Moreover, you would get complete waiver of 1 per cent fuel surcharge at authorised Indian Oil outlets.

Apart from spending on fuel, you would get 2 Turbo Points on Rs 150 spent at grocery stores and supermarkets.

Moreover, there will be zero annual fee if you spend Rs 30,000 or more in a membership year, else Rs 1,000 will be charged as annual fee.

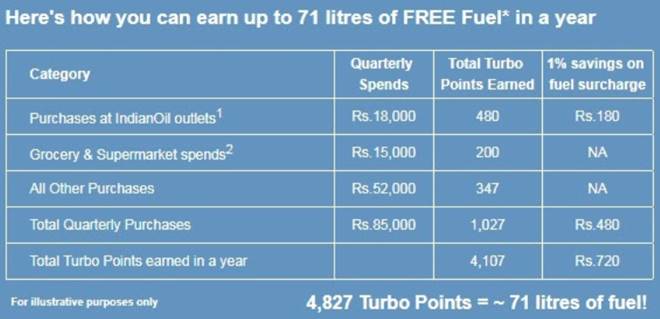

The following table illustrates how you may earn up to 71 litres of free fuel every year by using the IndianOil Citi Credit Card, subject to the terms and conditions given below the table:

The calculations are made taking average petrol price of Rs 67.84 and the redemption example is given for indicative purpose only.

Reward points may be redeemed for free fuel at a participating fuel outlet having Citi EDCs only (i.e. the point of sale (PoS) machine should be of Citi Bank).

As much as 4 Turbo Points will accrue for every Rs 150 spent for fuel purchases at Indian Oil outlets with the IndianOil Citi Credit Card.

Moreover, this benefit, along with the fuel surcharge waiver, would be applicable on Citi EDCs only.

The Turbo Points that accrue in this category would be capped to Rs 10,000 per transaction, i.e. no Turbo Points would accrue for transactions greater than in value to Rs 10,000.While 2 Turbo Points per Rs 150 will accrue on spends till Rs 5,000 (or 67 points) per month in the categories specified above. For spends beyond this, the customer will earn 1 Turbo Points per Rs 150 spent, where a month is defined as the statement billing cycle assigned to your card.