Financial instruments with tax benefits do more than just that. Buy them based on your plan

Are you about to buy a life insurance policy or put money in a five-year fixed deposit just to exhaust your section 80C deduction of Rs.1.5 lakh? As soon as the human resources (HR) department sends an email with a deadline to submit proofs of expenses and tax-saving investments, you may be tempted to buy the first life insurance policy that comes your way. In fact, 30% of about 300 respondents admitted to making the mistake of running around at the last minute to save taxes, in a survey by BigDecisions.com, a financial planning portal (see Haste makes waste).

If you, too, scramble at the last moment, this edition is especially for you. In this tax special, we have put together products that not only help you achieve a financial goal, but also save taxes. Before you get to them, start by taking stock of your investments; chances are you already have some such products, and don’t need to panic.

Here are three things that you need to do immediately to save your taxes wisely.

Look at all 80C products

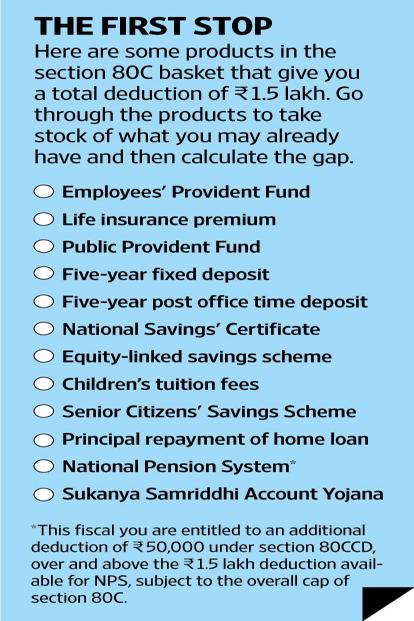

Section 80C of the Income-tax Act, 1961 allows you a deduction of Rs.1.5 lakh. A deduction is a reduction from total income and what is left is called taxable income. A deduction of Rs.1.5 lakh means tax saving of Rs.46,350 for someone in the 30.9% tax bracket.

Products in this section include Employees’ Provident Fund (EPF), Public Provident Fund (PPF), children’s tuition fees and also principal payments of a home loan. Many of these may already be a part of your investments or expenses. “We find that most people older than 30 years exhaust their 80C limit through home loan, EPF, insurance plans and tuition fees. As such they don’t have to look further. If there is still a need, we recommend equity-linked savings scheme (ELSS), because equity exposure is important,” said Pankaj Mathpal, a Mumbai-based financial planner.

Find out which section 80C products you already have and then calculate to see if a gap is left. For instance, a salaried individual with basic plus dearness allowance of at least Rs.12.5 lakh, and contributing to EPF, doesn’t have to worry about exhausting the section 80C limit. You put 12% of your basic plus dearness allowance into EPF, and that qualifies for a deduction. In the above example, the person’s EPF contributions would be about Rs.1.5 lakh, thus exhausting the 80C limit.

This, however, doesn’t mean you ignore the other products in the basket, which has some good, long-term products such as PPF, ELSS and National Pension System (NPS). You should consider these regardless of having exhausted your 80C limits (read more in the story Three products for long-term savings).

Go beyond 80C

There are products that are under other sections of the Act and offer tax deductions. For example, a health insurance policy. This is a must-have product, and the premium also qualifies for a deduction of up to Rs.25,000 under section 80D. This limit includes the deduction of Rs.5,000 allowed for preventive check-ups. For senior citizens, the limit is higher—Rs.30,000.

You get additional deduction of Rs.25,000 if you buy health insurance for parents who are not senior citizens, and Rs.30,000 if they are. For somebody in the 30.9% tax bracket, a deduction of Rs.25,000 means a a saving of around Rs.7,725 (read more on how to buy a health insurance policy in the story, How to build your health insurance portfolio?).

Apart from this, if you are paying off an education loan, the entire interest paid can be claimed as deduction under section 80E. Then there is an additional deduction of Rs.50,000 under section 80CCD for investments in NPS. This additional deduction was introduced this fiscal and is applicable over and above the Rs.1.5 lakh deduction available to you under section 80C. But should you invest in the NPS to save a little extra in taxes? For the answer, read the story Does NPS work for you.

Home loan: a big deal

You already know that the principal payment on a home loan qualifies for a tax deduction under section 80C. But did you know that even the interest component of your equated monthly instalments (EMIs) qualifies for a deduction? It does. But the amount will depend on whether the property is self-occupied or let out. The interest portion on a home loan for a self-occupied house qualifies for a deduction of up to Rs.2 lakh under section 24(b). If the property is rented out, the entire interest amount can be claimed as deduction.

However, you need to keep in mind that if your house is still under construction, these tax breaks are not available immediately. The EMI that you pay comprises mostly the interest and some principal (in many cases, the entire amount may be towards interest and none towards principal). So, section 80C tax break for the principal payment is not significant, or totally ruled out. But once construction is complete, the interest that you have paid can be claimed as deduction in parts. Read more on all the tax-related provisions related to a home loan in Home loans: heavy liability but also big on tax benefits.

Missed the HR deadline?

Don’t panic. Ideally, you should be able to submit all your proof of investments to the HR department to make sure excess income tax is not cut from your salary. But if that doesn’t happen, and tax is cut, all is not lost—you can still claim for a refund when filing your income tax returns. This you can do for investments made in the same financial year. You are not required to attach documentary proofs with the return, but you should maintain proofs in case the tax department has queries.

Spend some time to take stock of your tax savings. Try to evaluate your income and investments at the beginning of the financial year. But if you have missed the bus, take the time to read this tax special, which takes you through some not just tax saving products but also efficient product strategies.